MULTI-STRATEGY & SYMBIOTIC

OPPORTUNISTIC & EXPERTISE FOCUSED

VALUE & GROWTH BALANCE

Maximus Value Capital is a fund of funds and a diversified investment holding company and family office located in New York City and Menlo Park, CA. The organization has global interests in agribusiness, telecommunications, entertainment, financial asset management, philanthropy and real estate. Our investment portfolio is comprised of direct investments as well as partnerships with many leading investment managers.

Maximus Value Capital Partners generates safer and stronger investment returns by being very good at selecting the right value targets and delivering on a number of significant value improvement strategies, that in combination have been proven to deliver extraordinary returns on investment in a safer manner.

PE Fund Management & Investments

SPV & Direct Investments

Programmatic JVs & Separate Accounts

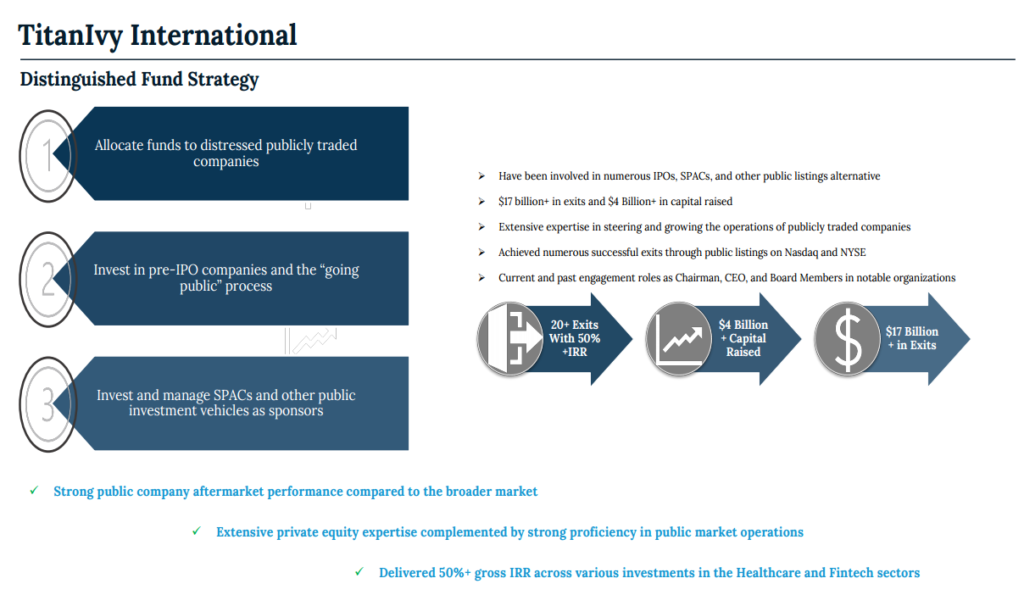

Maximus Value Capital Partners is a generalist value investor and supports a number of specialty expert funds and sub-funds including impact investing, value investing, agriculture & food tech, enterprise software, retail and underperforming RE mixed use conversion.

We believe in industry diversity and have a strong generalist approach to investing, although we do this in a unique specialist / generalist hybrid model, where we make sure that we already have or can bring on board that specialist expertise to maximize value on each investment that we make.

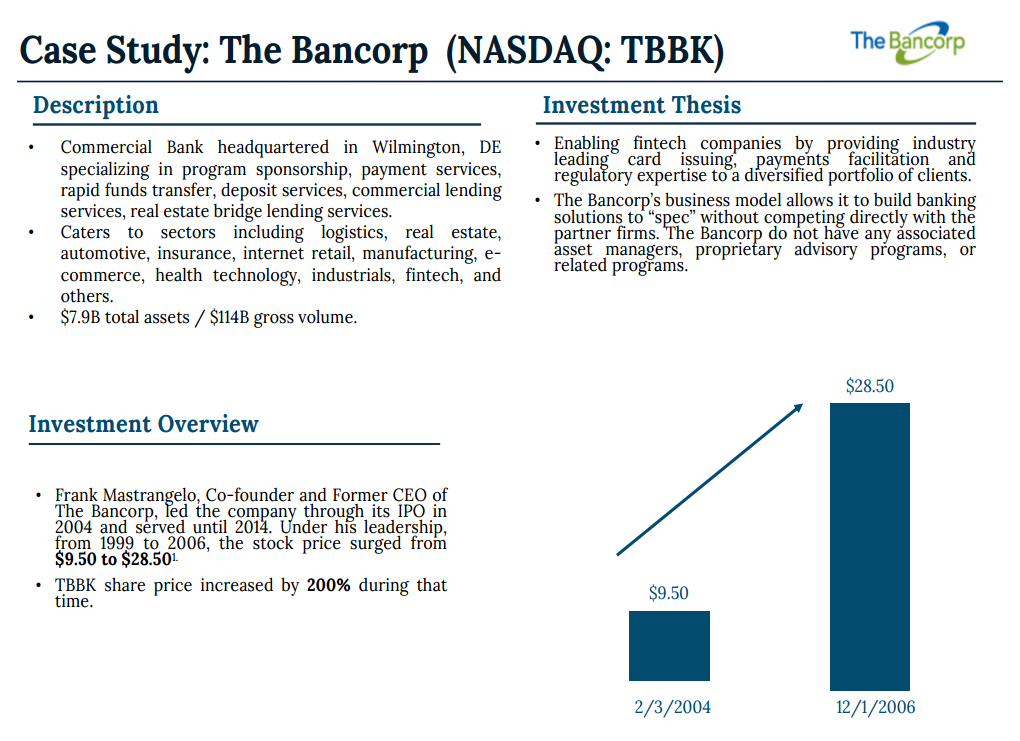

Completed NASDAQ IPO Transactions

Maximus Value Capital Partners is an expert in a number of value and growth improvement strategies and is constantly in search of identifying and delivering new and better ways to deliver value to our investors.

Opportunistic Secondary Direct Deal Fund of Funds

MVC Partners also specializes in providing alternative liquidity solutions to private equity asset owners on a direct and indirect basis. We acquire private equity positions directly through portfolio and single asset transactions and can also partner with incumbent managers to provide liquidity to limited partners. Our transactions are highly tailored in order to address particular objectives of sellers as well as the needs of the incumbent managers and underlying portfolio companies. Working with MVC Partners provides a discreet solution, smooth transition, and continued value creation for all stakeholders.

Maximus Value Capital Partners is a founding member of the Middle Market Private Equity Alliance, that provides support to middle market focused private equity funds and direct investors.

An edge MVC has over other venture and private equity firms is that we deploy an army of wall street types who have cut their teeth working 100 hours a week for years. Their work ethic shines through in how we do due diligence and how each company is managed and prepared for its exit. We also have developed a sophisticated deep tech platform that allows us to take our due diligence significantly deeper both during the initial due diligence and during our weekly reviews with the management teams.

In addition to real estate, enterprise software, agri-tech and consumer investing, our team also has a 20+ year track record in developed and emerging markets sovereign and corporate distressed, event-driven and high-yield credit investing.