Add-on acquisitions create immediate significant value and arbitrage for the acquirer, and our team has a significant experience in acquiring add-on acquisitions and has a powerful platform for value and growth focused integrations.

Maximus Value Capital Partners constantly reviews new Add-on Acquisition deal flow, and has a large network of advisers and consultants who provide our team access to numerous high value deals and who provide deep insights into the current situation of each such company that we are reviewing and tracking.

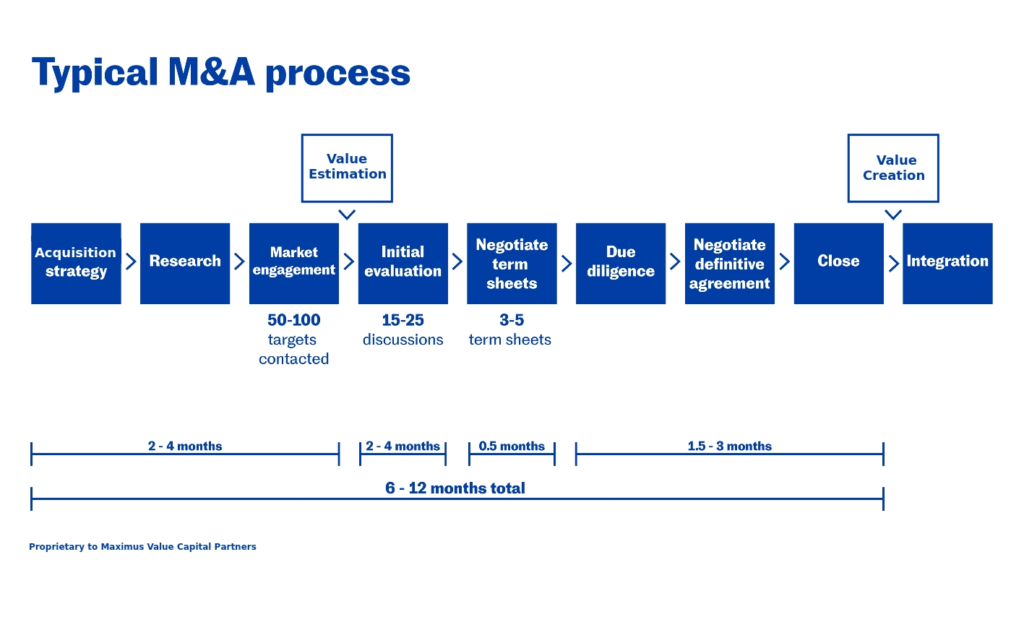

Prior to making any acquisition, we conduct a deep dive analysis on at least 200+ competitors and potential add on acquisitions and begin to continuously review and to prepare additional acquisition targets for our companies, as we believe that it is much easier and faster to buy customer accounts, great teams and great technologies that to build or to acquire these from scratch.

After participating in dozens of mergers and acquisitions, we have developed a proprietary platform that allows us to maximize value from tracking and measuring the performance of each knowledge worker. Whether its sales, technology development, R&D or customer service, our platform allows us to generate insights into the value of each employee prior to the merger and post merger, thus allowing us to help eliminate resources that do not bring any extra value and to help valuable resources deliver at their best both during the acquisition and post merger.