NASDAQ PRE-IPO:

Opportunistic Growth with Structural Protection

The MVC KW Pre-IPO Fund II builds upon the successful track record of the management team and of its Fund I taking numerous companies public on NASDAQ.

Completed NASDAQ IPO Transactions

Leveraging decades of capital market experience, access to pre-IPO NASDAQ transactions, and deal structuring, the Fund targets market inefficiencies to create significant equity returns, while mitigating risk – short term capital gains and warrant coverage to provide excess returns utilizing convertible debt structures.

Fund Overview

Decades of capital markets experience and relationships filling unique void in the emerging growth space

Targeting inefficiencies to create equity returns with debt protections: Mitigating

risk through ideal structures and capitalizing on alpha to maximize short term capital gains.

Defined hold timelines for investments and penalties for missing targets in a de-risked, senior-secured structure and warrant coverage to provide cycled, short term capital gains opportunities

Investment Criteria

Near-Term Event: Focus on companies that are ready and able to IPO in the primary NASDAQ markets within 6 months target, but no later than 18 months.

Growth Sector Agnostic: Although the Fund expects to invest in growth industries suitable for the Nasdaq Public Markets, such as healthcare (pharma, device, diagnostic, services), technology, consumer technology and products, ESG, crypto and NFT, the fund is agnostic toward industry.

Structural Integrity: Utilize direct-managed, primary investment structures like bridge structures, senior-secured, convertible, warrant coverage, and penalty structures in the private market with pre-defined liquidity event within 18 calendar months.

Risk Mitigation: Collateralized investments, liquidation preferences, pricing reset provision, defined liquidity event, and holding the convertible position until IPO and subsequent exit.

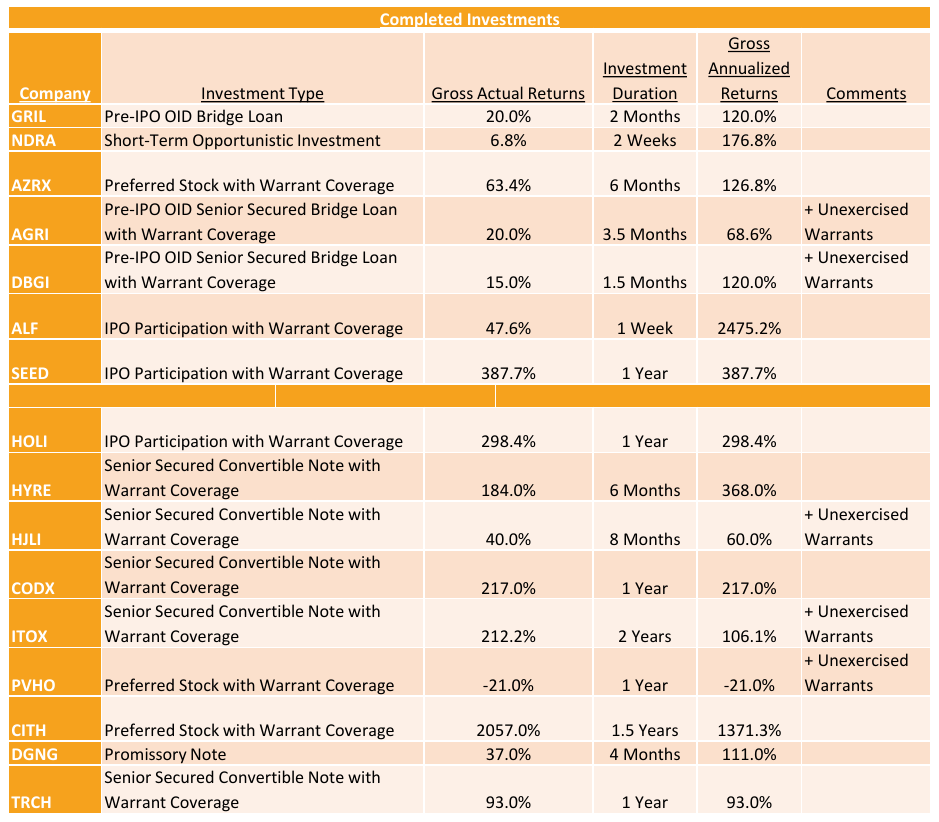

Completed Investment Summary

As with our past investments, each of our future investments is expected to be banked by our highly experienced partners. They will run the up-listing jointly, same as in our prior deals. Between the partner banks, we have in excess of 300 brokers with over $10 B in assets and we have the utmost confidence in our partner’s ability to get every IPO we invest in completed.

As with our past Pre IPO NASDAQ investments, each of our investments is expected to be a fairly de-risked investment, given the fact that multiple highly experienced banks will be engaged in working on the IPO on Nasdaq and given the fact that every company we invest in will be already generating significant revenues, will be fast growing, and will have several impressive contracts and acquisitions opportunities aligned and expected in the near-term.

The traditional plan is investing into Senior Secured Convertible Notes, to get an average of a 10% OID plus monthly interest that will be added to our note, convert at the IPO with a 35% discount and sell pretty much immediately to lock in our 50+% gains and keep the warrants for potential future price appreciation.