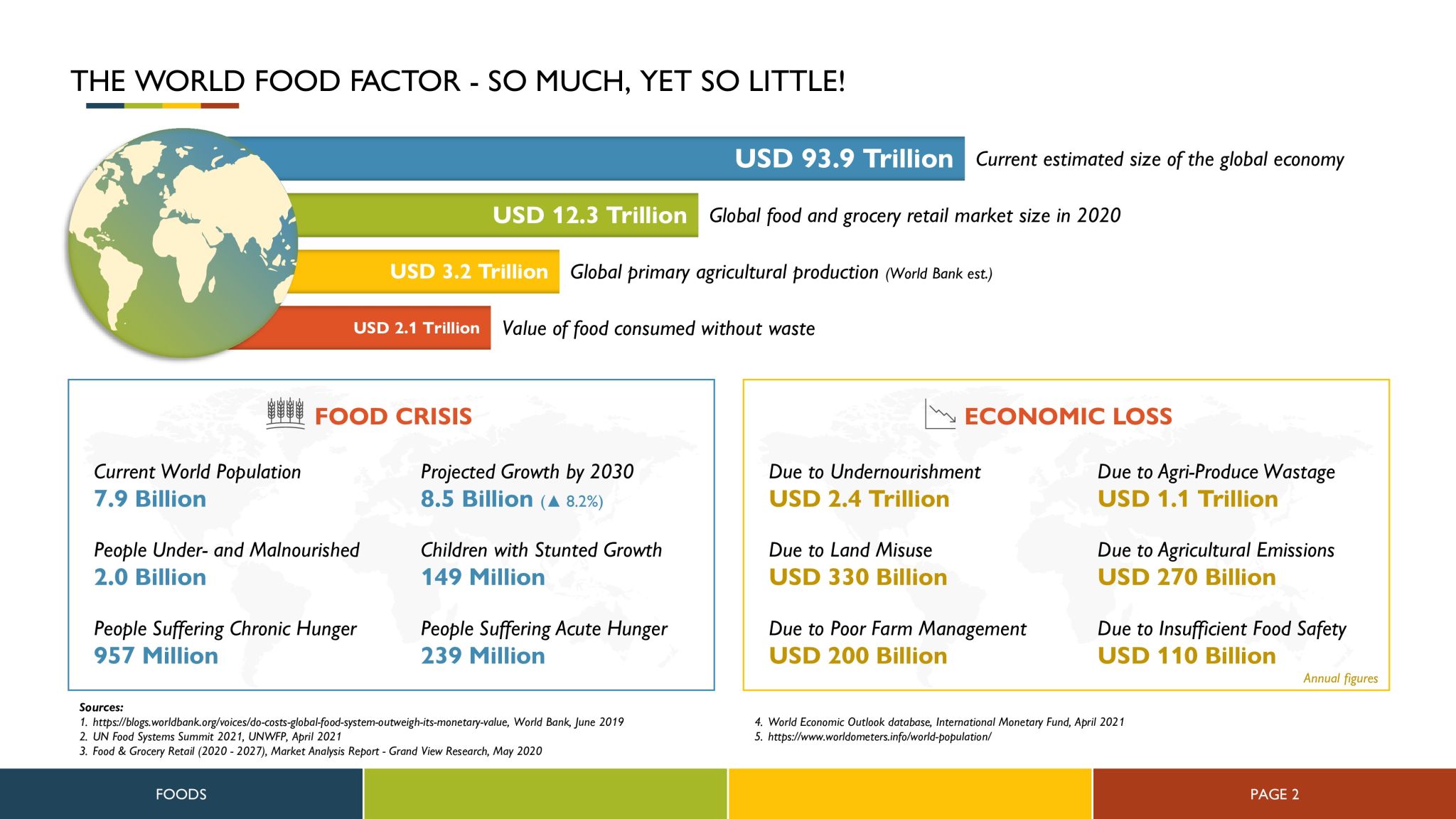

Investing into sustainable wellness agriculture and organic nutraceuticals, high yield seed and healthy food production

The MVC – Live Longer Foods AgriTech Fund LP is focused on investing into profitable GLOBAL agriculture, food, bio technology and nutraceutical trends and opportunities. Our team has 20+ years of experience successfully investing into agriculture, bio technology and life sciences across four continents. Our “secret sauce” formula, know how and strategy are based around 20+ years of partnerships with major agriculture land funds, farmer cooperatives and farmer NGOs to manage investments and relationships with over 500,000 farms.

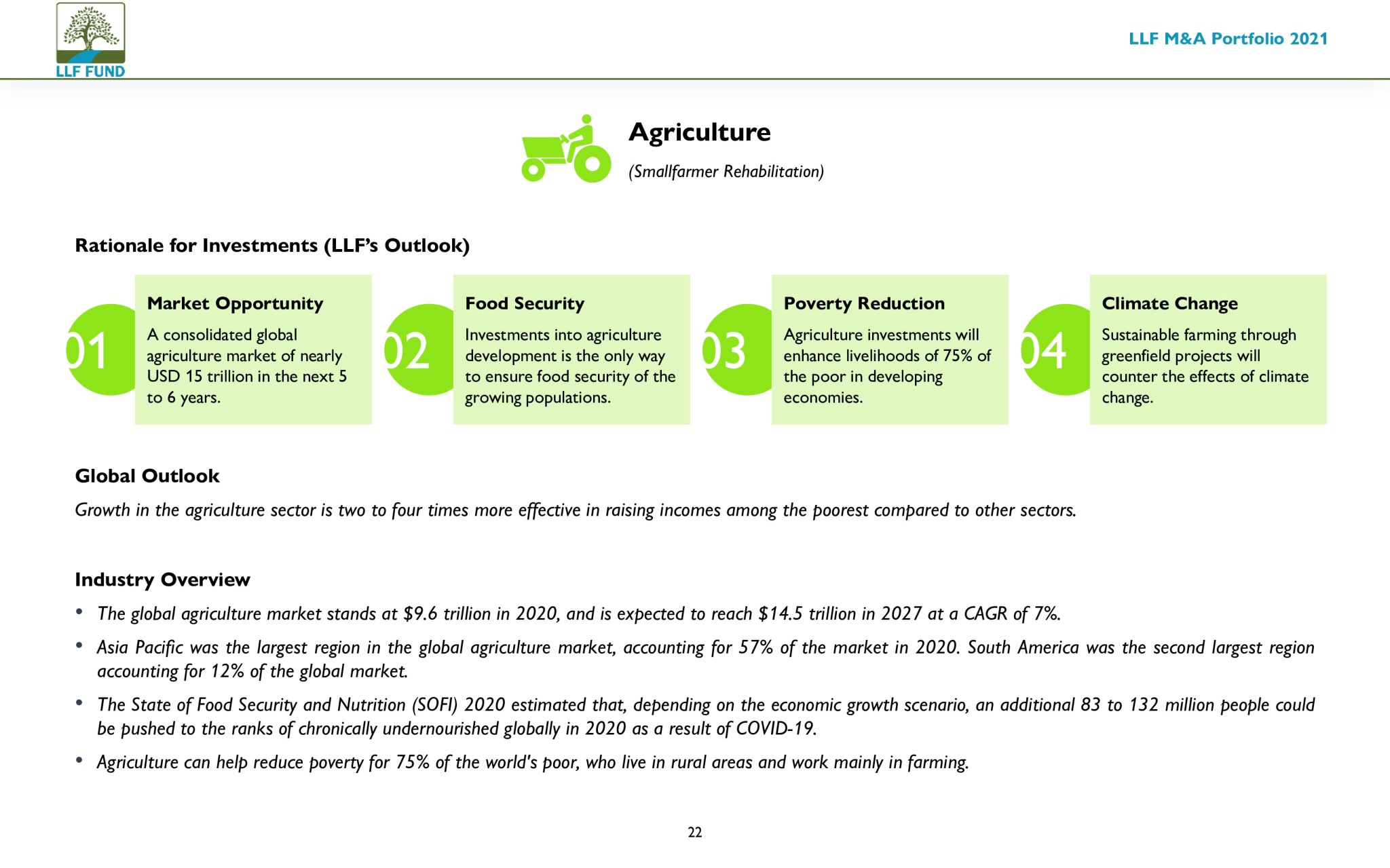

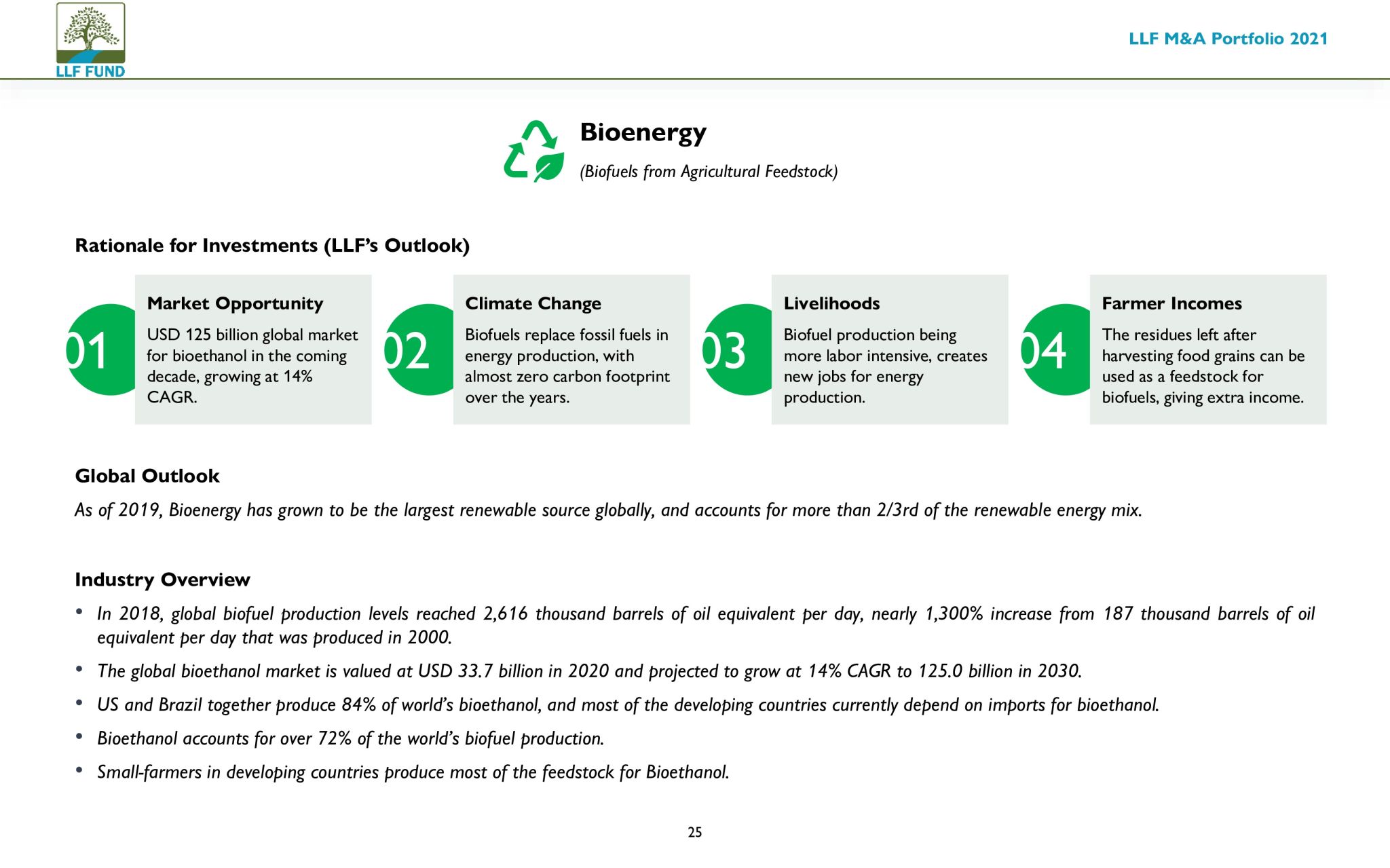

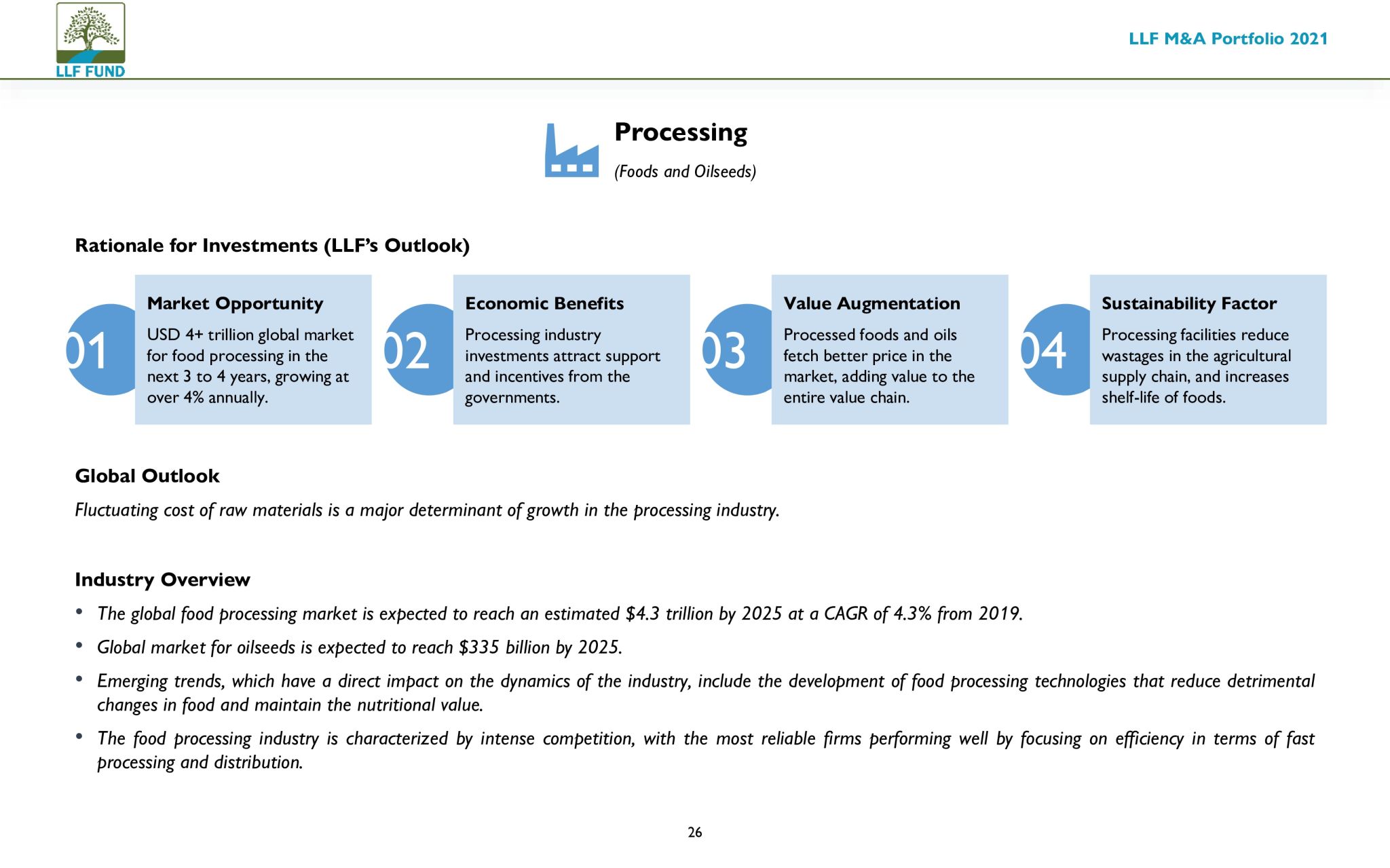

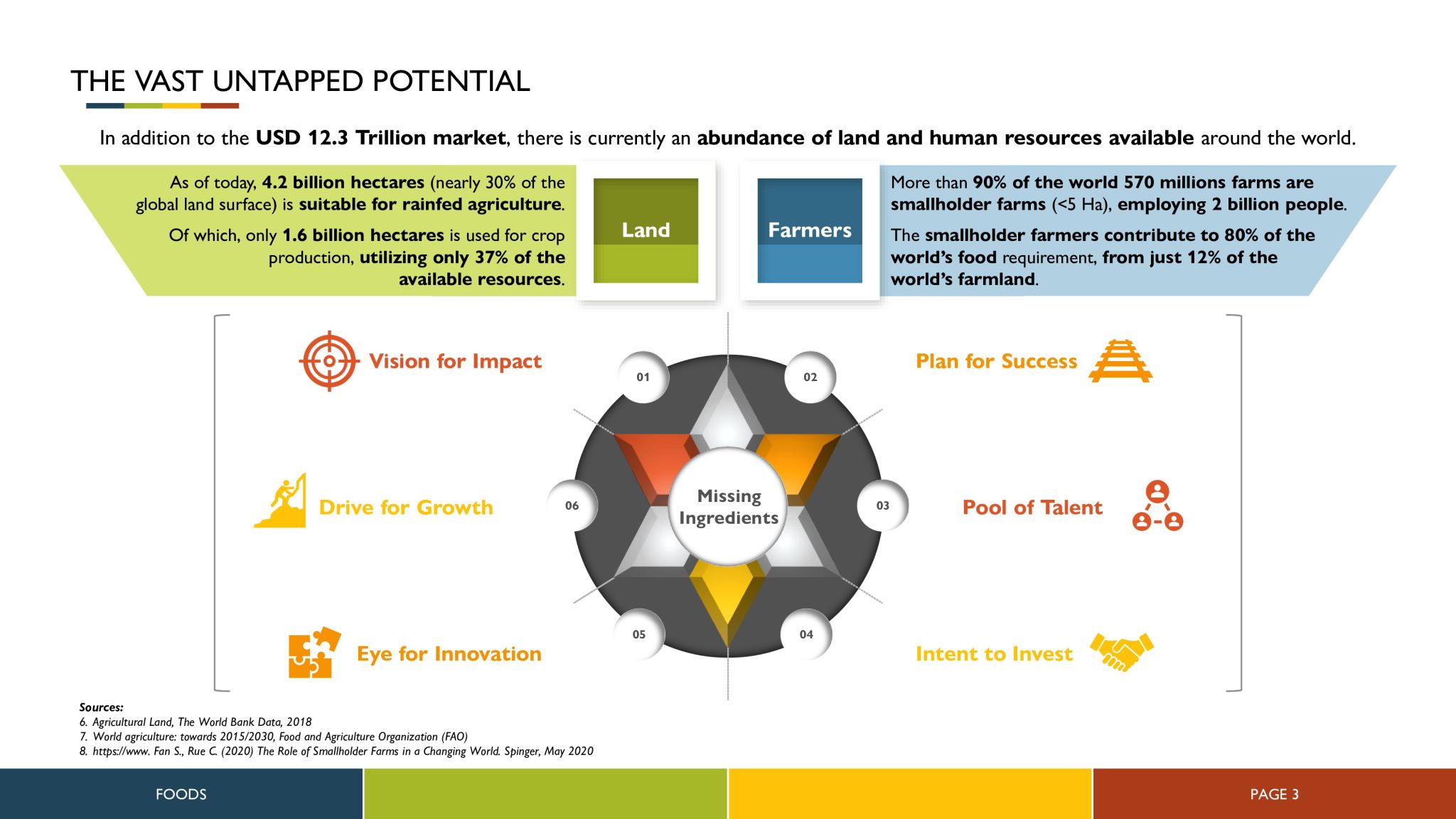

The MVC AgriTech Fund is investing into revenue generating companies in the food and the agriculture sectors, especially focused on sustainability, social and environmental impact, small farm management and wellness, waste to fertilizer, efficient trading and logistics and biofuel. MVC AgriTech focuses on companies with at least $5 million in EBITDA. Our team has a strong investment track record in the food and agriculture space.

Our group of companies is currently managing 500,000 farms and organic nutraceutical, high yield seed and sustainable agriculture production and distribution across 12 countries in Africa and South East Asia, and is rapidly growing into what we expect to become the largest wellness seed to farm to fork platform and farm management group with over 5 million farms under management planned in the next 3 years.

Originally funded in a partnership with the E. L. Rothschild Ventures Family Office, the effort opens numerous opportunities for government and international NGO contracts, and to creating numerous ESG conscious winners, delivering both significant returns for investors as well as food safety, job and income security, improved health and wellness, environmental sustainability and numerous other benefits to our partners and customers and to our planet and society in general.

Partnering with farm land funds and farmer organizations that own and control billions of dollars in farm land, and our close relationship with hundreds of thousands of farms provides us with a unique advantage of being able to test potential agritech investments on real potential customers both across the US and globally, providing us with a distinct advantage both during our due diligence process and helping us to quickly grow our portfolio companies by presenting them to hundreds of thousands of captive potential customers.