Maximus Value Capital is a private investment management firm providing real estate and alternative investments to the sovereign wealth fund and institutional investment communities. For over 35 years the MVC team and/or its affiliates have formed or acquired companies with more than $24 billion in assets and have a longstanding history developing new industries and outperforming their competitors.

MVC KW PRE-IPO Fund II

NASDAQ PRE-IPO:

Opportunistic Growth with Structural Protection

Completed NASDAQ IPO Transactions

The MVC KW Pre-IPO Fund II builds upon the successful track record of the management team and of its Fund I taking numerous companies public on NASDAQ.

MVC Enterprise Software Investments LP

MVC Enterprise Software Investments is an investment fund focused on investing in best-in-breed regional and global enterprise software product and service leaders, focused on creating a collaborative of strong sales and service leaders and technology innovators, focused around the concepts of no code, digital, mobile, automation, digital twin, 3d visualization and AI transformation and organizational intelligence in industrial, manufacturing, energy, construction, logistics, infrastructure and facilities management and smart city verticals and on providing our partners with access, support and incentives to work together to deliver extraordinary results for their teams, for our global conglomerate and for our partner and portfolio companies.

MVC Digital Manufacturing Partners LP

Growth Technology – Value Acquisitions – Opportunistic – Global – ESG

MVC Digital Manufacturing Partners is an investment fund focused on digital transformation of light global physical goods manufacturing in the low capex industries.

Maximus Value Credit Capital LP

“Low Volatility yet Higher Yield”™ Credit Investing

The Maximus Value Credit Capital leadership team has a 20+ year track record in developed and emerging markets sovereign, municipal and corporate distressed, event-driven and “low volatility yet higher-yield”™ credit investing.

MVC Commercial Partners LP

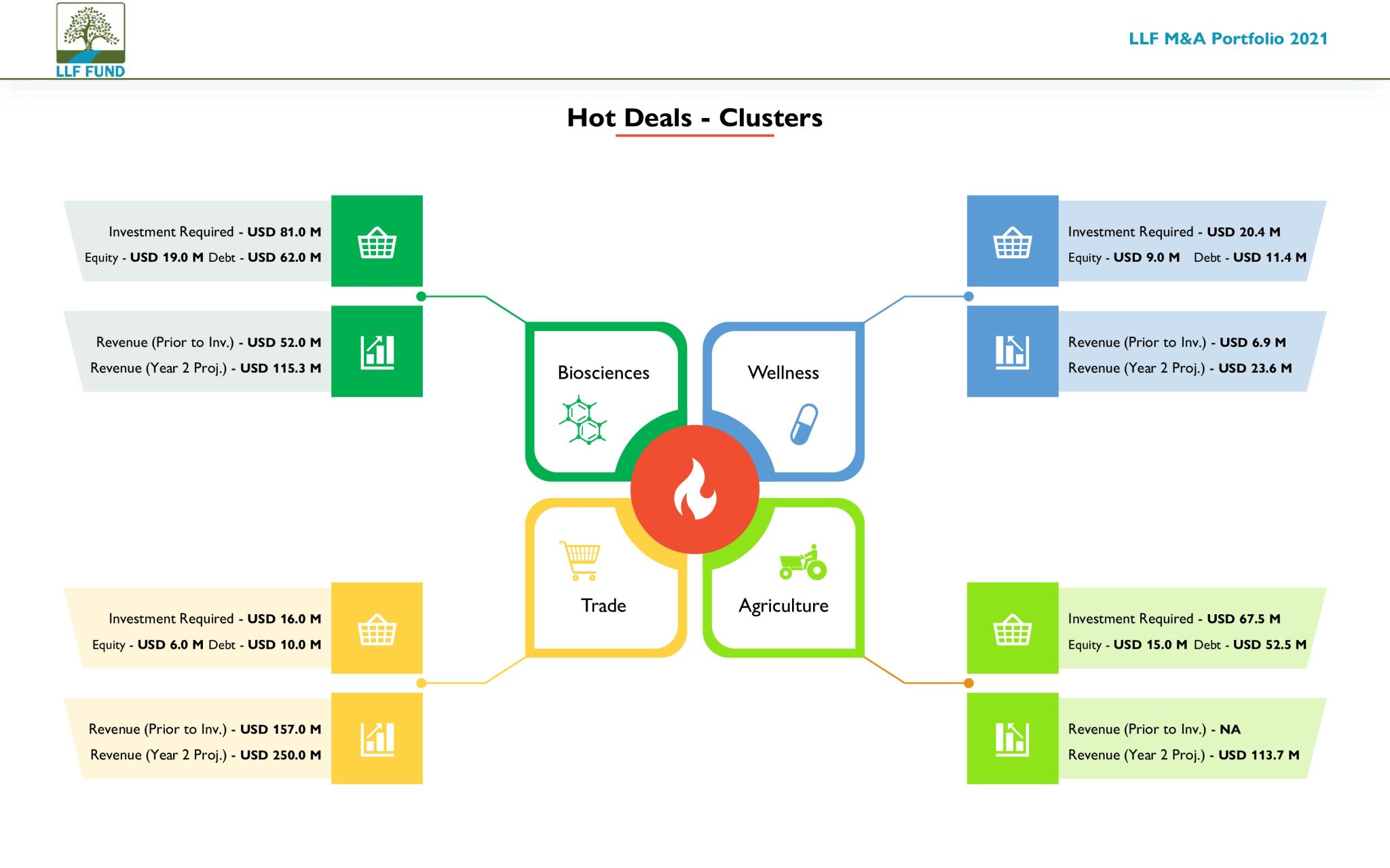

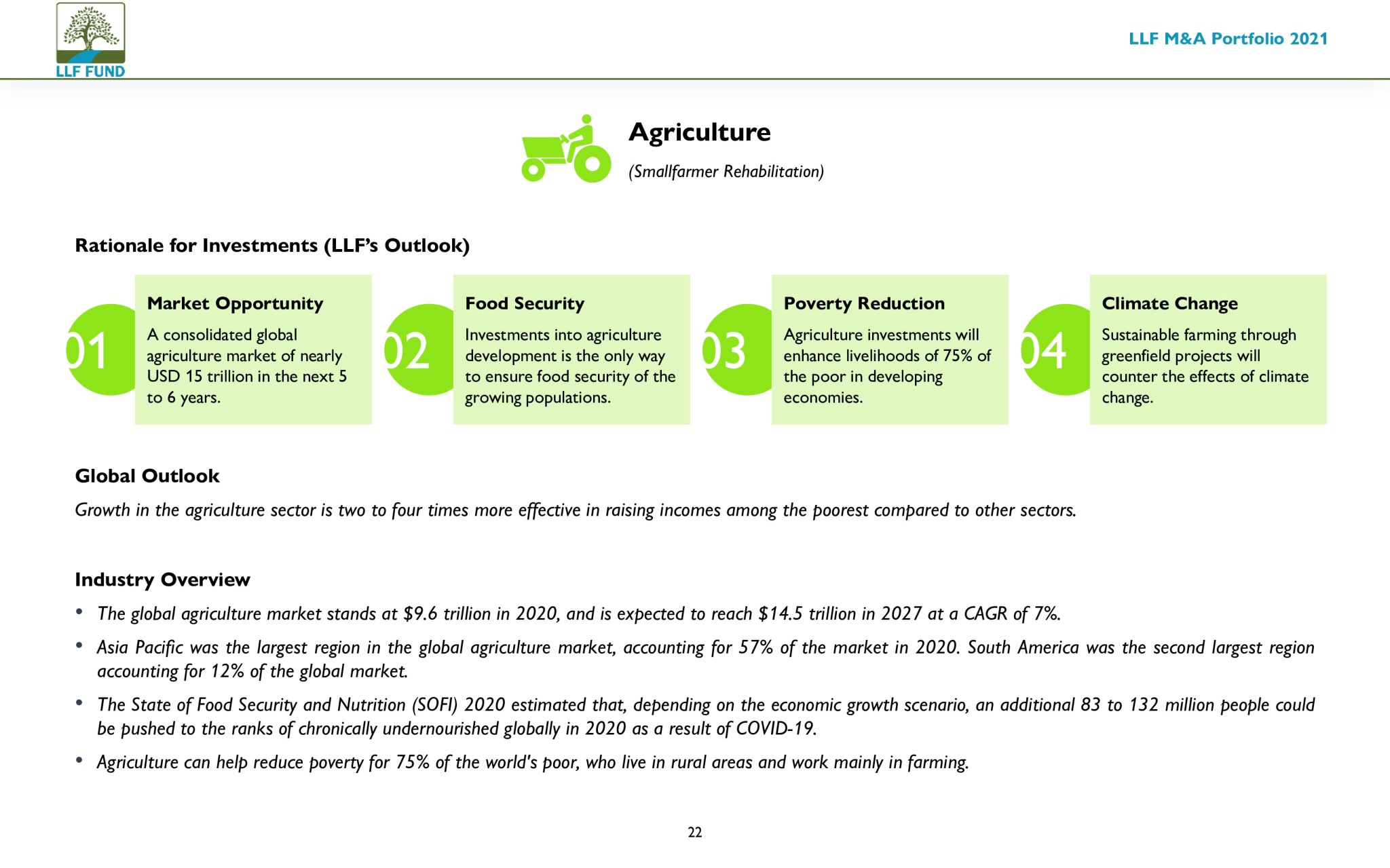

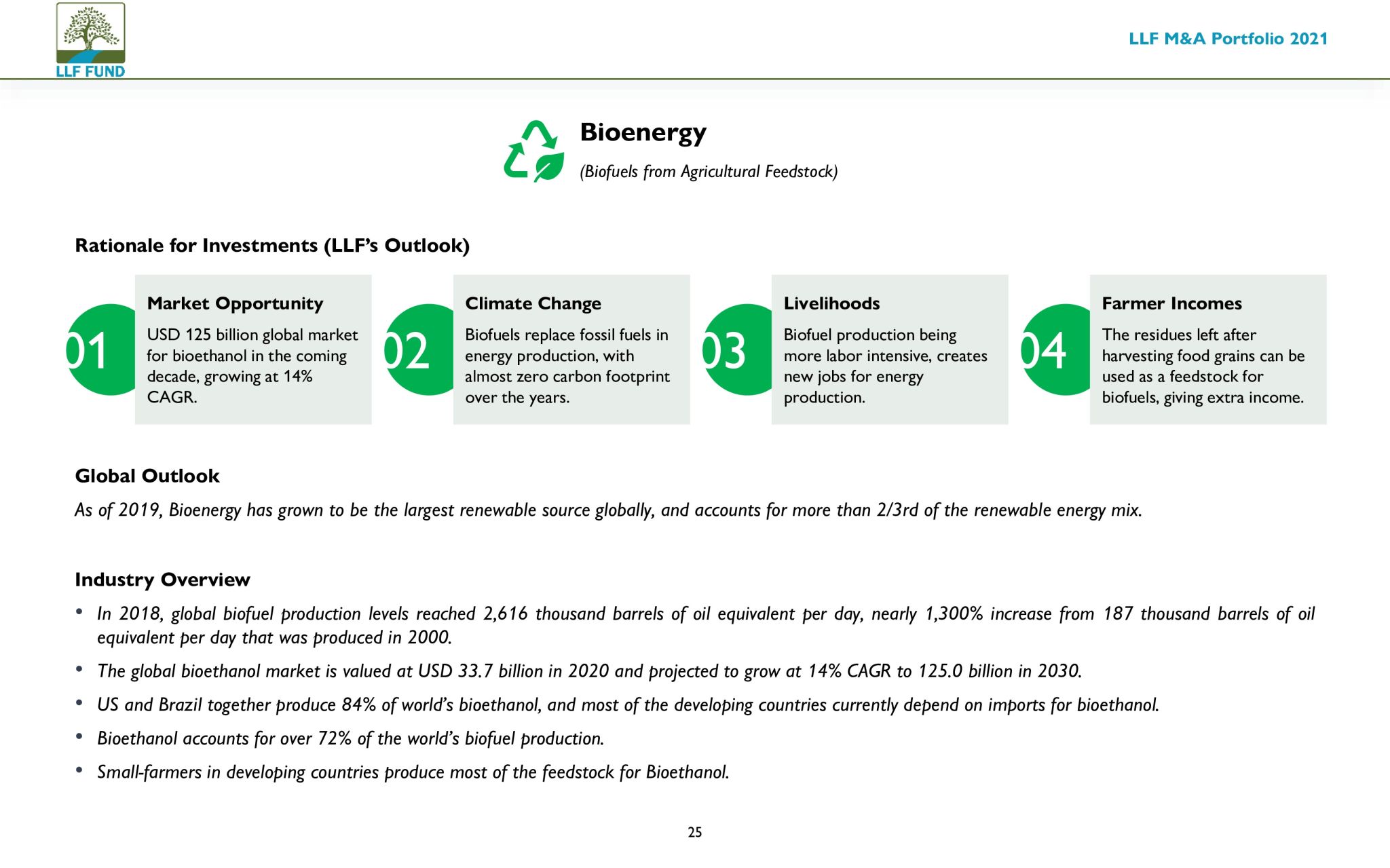

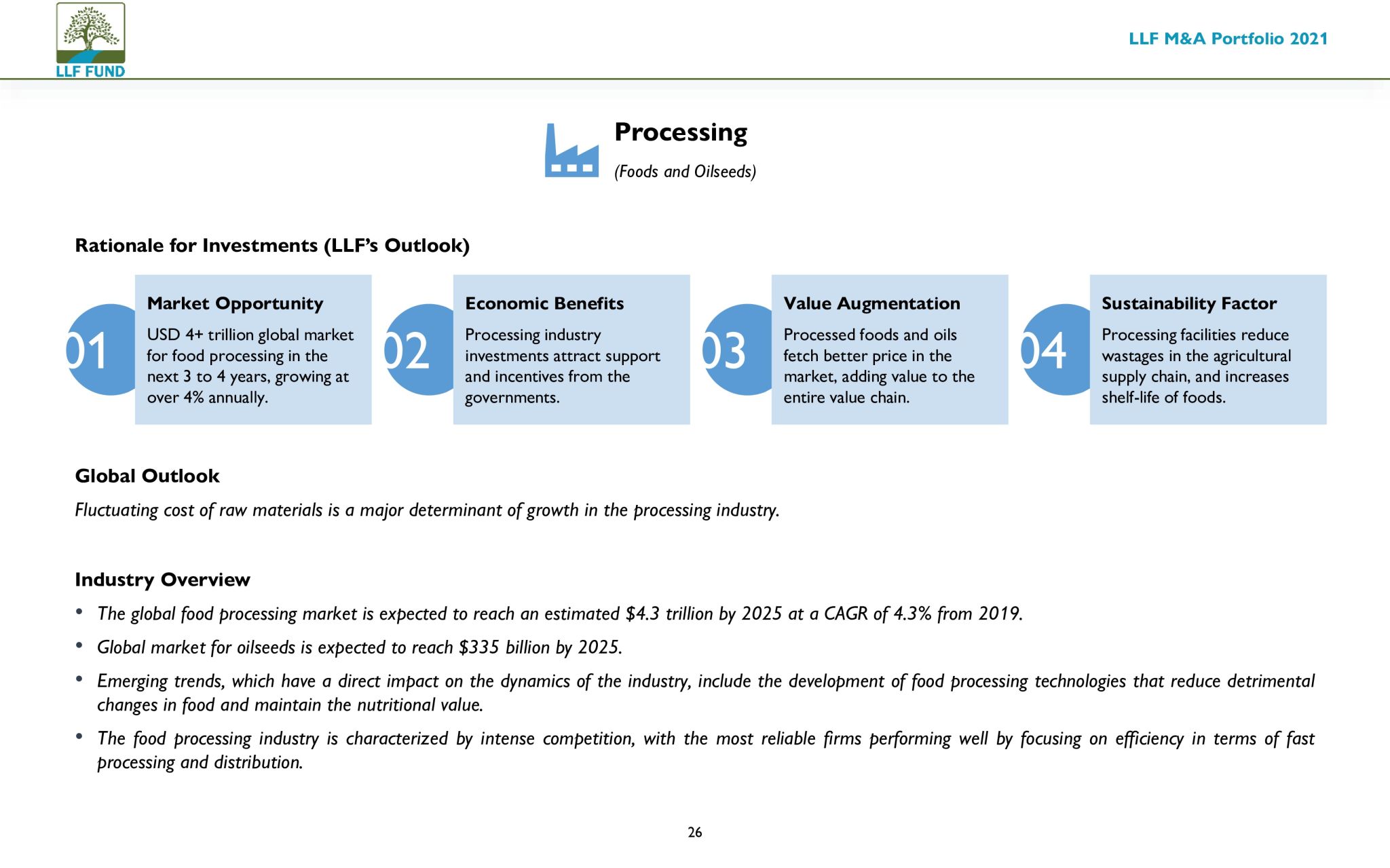

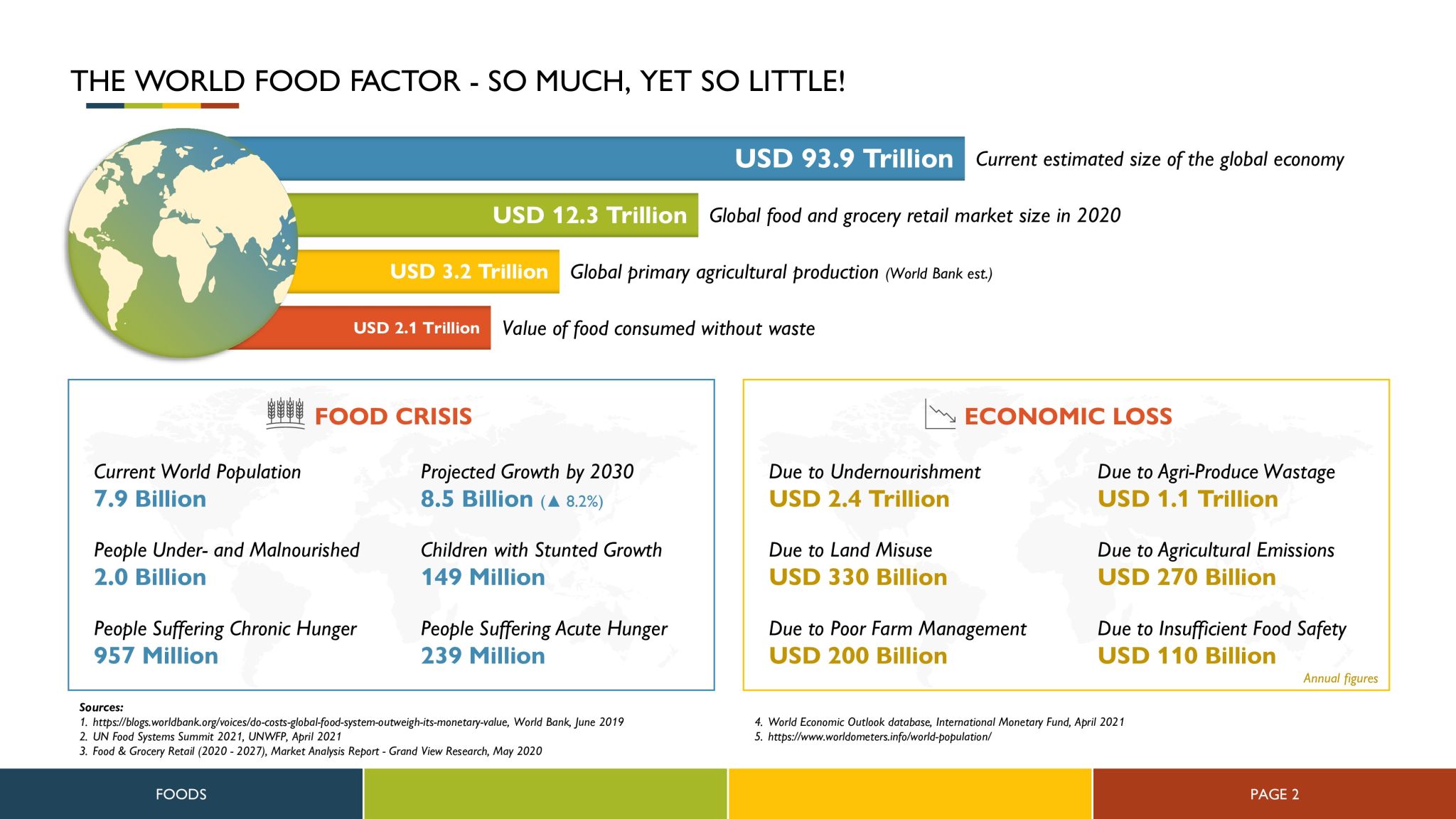

MVC-LLF AgriTech Fund LP

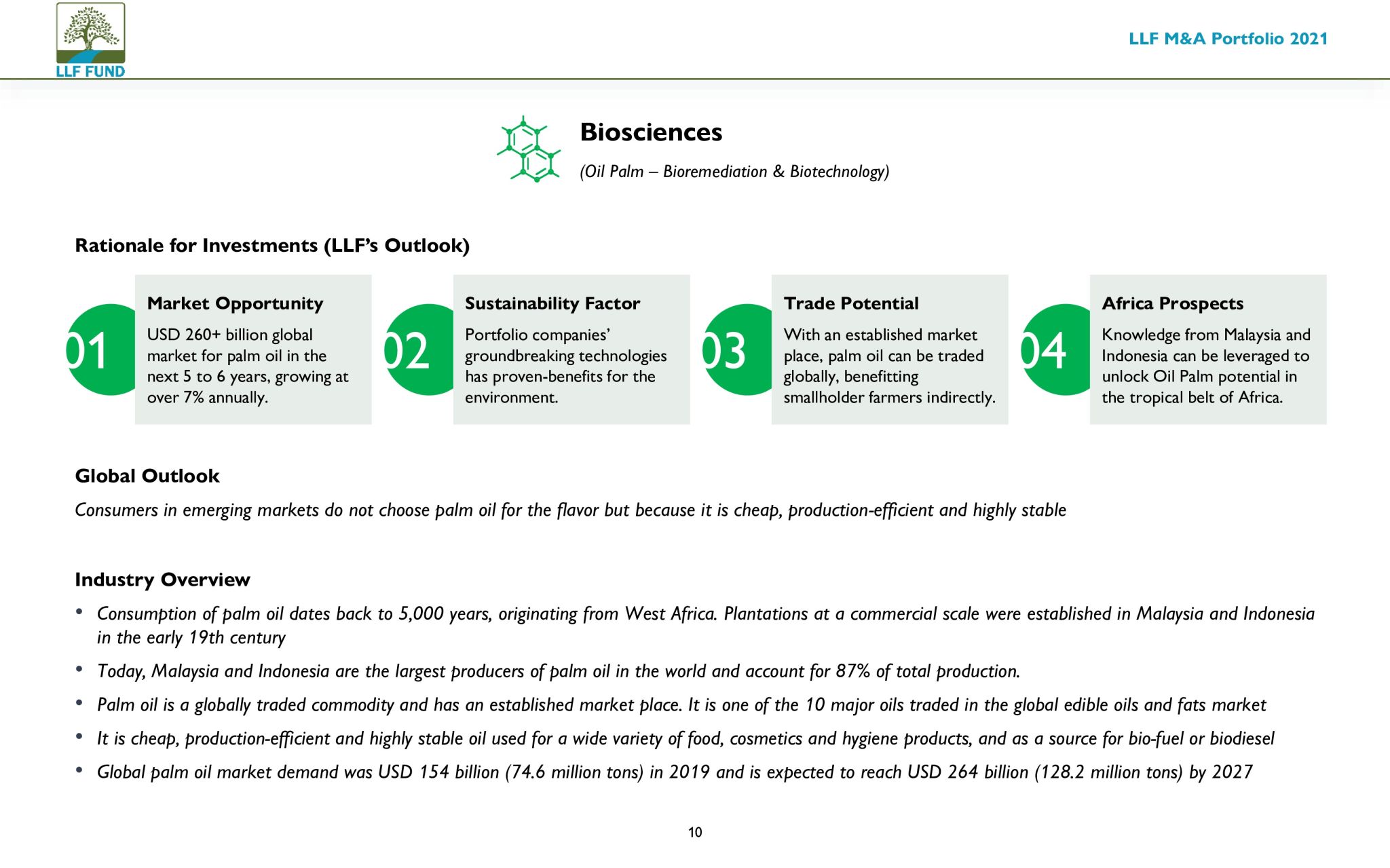

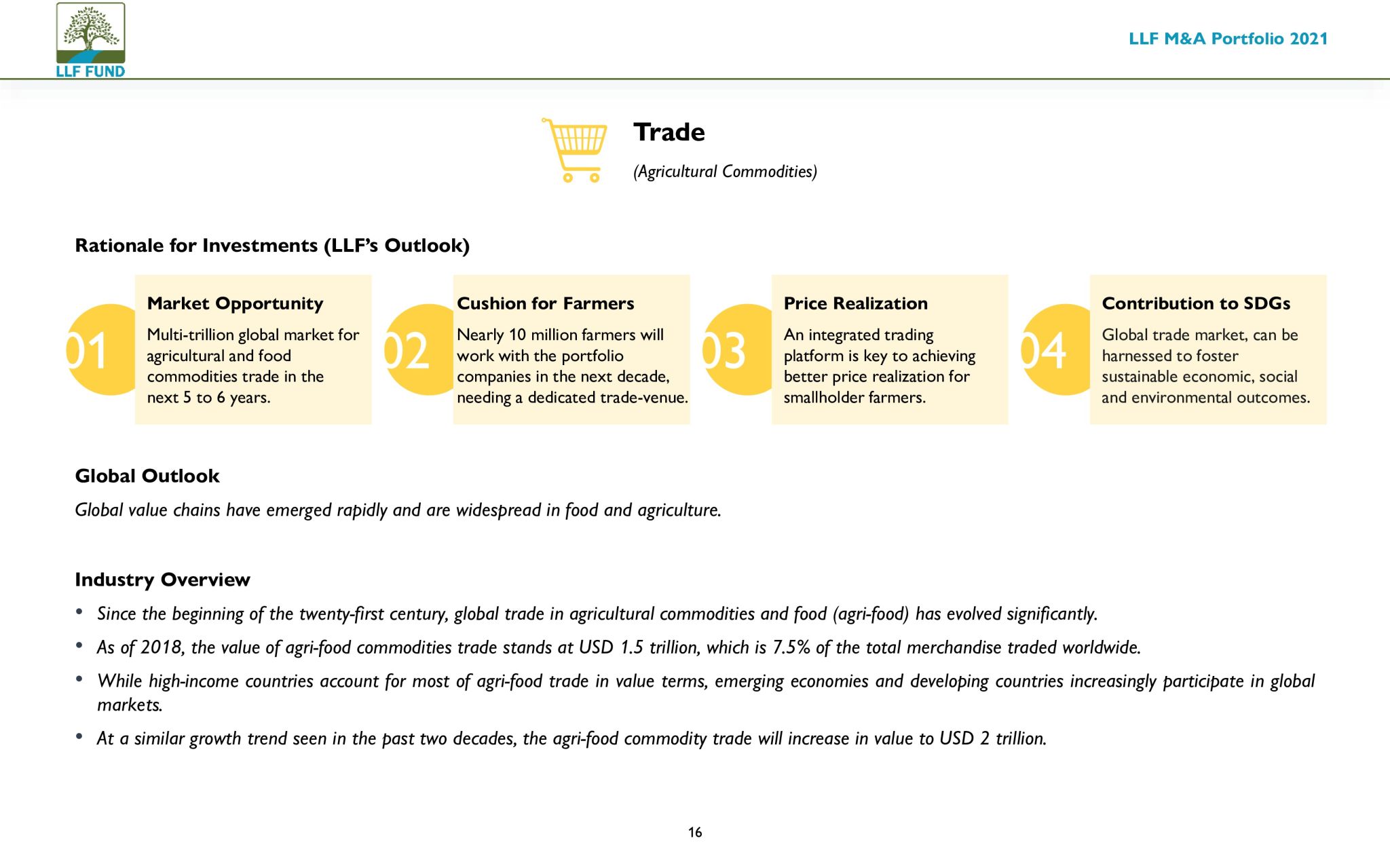

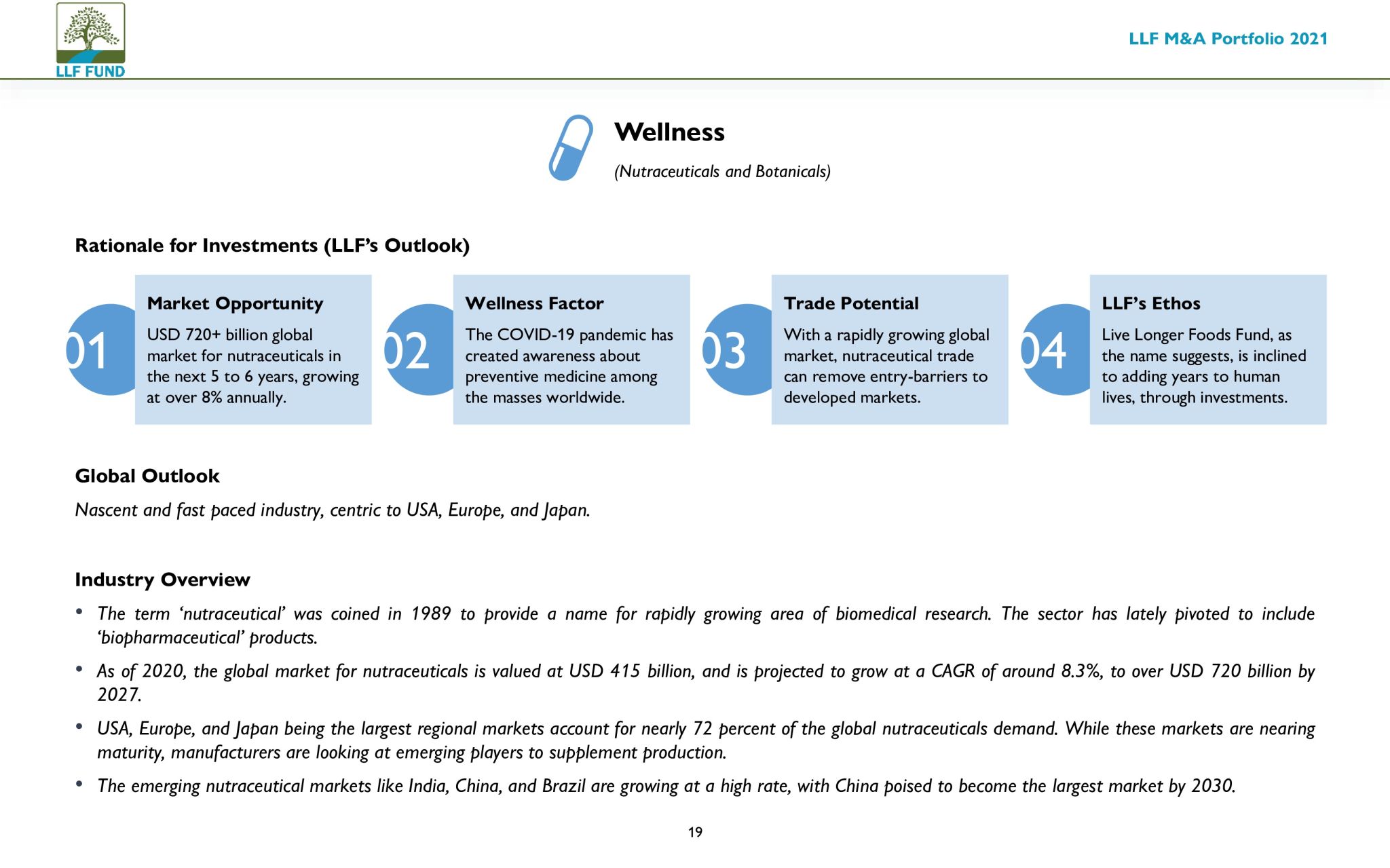

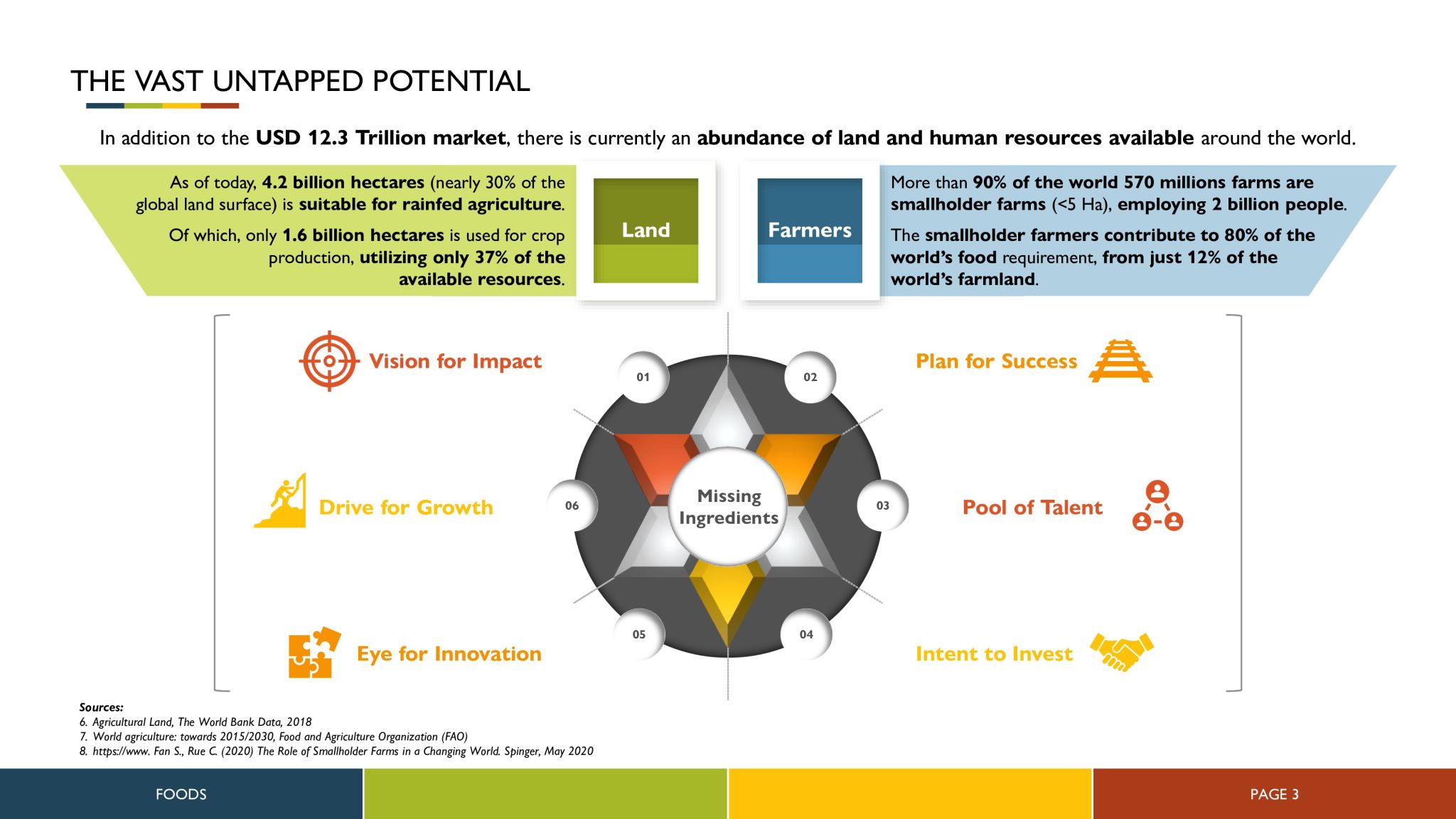

The MVC – Live Longer Foods AgriTech Fund LP is focused on investing into profitable GLOBAL agriculture, food, bio technology and nutraceutical trends and opportunities. Our team has 20+ years of experience successfully investing into agriculture, bio technology and life sciences across four continents. Our “secret sauce” formula, know how and strategy are based around 20+ years of partnerships with major agriculture land funds, farmer cooperatives and farmer NGOs to manage investments and relationships with over 500,000 farms.