Maximus Value Capital Partners utilizes a combination of numerous proprietary strategies, that have been perfected by our team over a number of years and that MVC utilizes to deliver above average returns with a lower risk profile.

Preparing for an IPO

Our team has developed a niche investment market in Pre-IPO deals and over the years has provided our partners with access to well-managed and well vetted Pre-IPO growth companies in the round of Pre-IPO investing.

Going public requires management to be prepared to meet shareholder and market expectations from day one. This includes addressing ongoing compliance and regulatory requirements, operational effectiveness, risk management, periodic reporting and investor relations.

Our team has a proven track record involving dozens of complex IPOs giving us a unique insight as to how to get companies to an IPO quickly and efficiently and to understand the relevant timing issues to maximize value and to be ready with proactive resolutions of issues resulting in fewer surprises and delays in the IPO process..

Growth Equity

As a value focused growth equity firm, our focus lies right in between the intersection of the private equity and venture capital industries, carrying the best elements of both allowing us to deliver extraordinary results for our investors and partners.

We often are seeking out companies that require help, but where the business is based on solid underlying principals, strong competitive advantage and high growth potential, and that are looking to finance an extraordinary company event such as expanding product development, entering new markets, or undergoing financial restructuring allowing to further accelerate growth and to provide the foundation for an eventual merger or IPO.

Perfecting Human Efficiency

Having participated in hundreds of acquisitions, we understand the biggest challenges of thought worker and field worker inefficiencies especially in a post merger / acquisition environment.

Over the last decade our teams of scientists and social engineering experts have devised a proprietary platform and a strategy allowing us to evaluate and to measure the performance of each thought worker whether working on their computer or on their mobile, and whether writing code, creating marketing materials or making sales, and to provide them feedback via AI based training tools, to both increase their efficiency and to teach them how to maximize the value they are delivering to the company.

Add-on Acquisitions

Add-on acquisitions create immediate significant value and arbitrage for the acquirer, and our team has a significant experience in acquiring add-on acquisitions and has a powerful platform for value and growth focused integrations.

Alternative Lending

Maximus Value Capital Partners provides equity or alternative capital solutions to assist high quality companies and management teams in making strategic acquisitions, financing capital expenditures or growth programs or supporting working capital requirements. Our portfolio companies are supported via both equity investments and via alternative lending solutions. We can assist those companies that may not qualify for conventional bank financing, or need to supplement their existing credit facilities, by providing a flexible and custom designed debt products. We quickly evaluate company needs and provide timely capital for our portfolio company operations secured via assets, working capital or corporate equity.

Non-Dilutive Capital

Our team has many years of experience attracting non-dilutive, less dilutive and less invasive debt, grant and other forms of government and non government funding in the forms of grants, contracts, earmarks, general loans, economic incentives, structured equity products, annual recurring revenue loans, and tax incentives among other similar products and funding alternatives for the companies we invest in. We have attracted millions of dollars for companies by having their technologies declared technologies of national importance, and by understanding the political landscape that each location provides.

Roll-Ups

We target large, yet highly fragmented industries with no real dominant players, often times in emerging markets and often look for deals with increasingly onerous government regulations that our companies can navigate easily at scale.

We look for companies with a proven operational formula that can be applied to acquired companies in order to create value or help our consolidator develop and to prove a strong operational formula so that it can drive meaningful growth and profitability for the acquired add-on companies.

Other MVC Value Creation Strategies

Revenue Value Acquisition – The MVC team has a significant amount of experience finding and acquiring highly undervalued revenues, and increasing our portfolio companies’ revenues and the bottom line

Change of Domicile and Cross Border Expansion – Our team has many years of experience working globally across borders both in the US and Western Europe as well as in South East Asia, Eastern Europe, Latin America and India and understands how to reposition and to expand companies successfully into new markets

Team Expansion – We have a very strong network of C level management, marketing, sales, finance and technology leaders globally to help bring in additional team members when required to help supplement the existing team

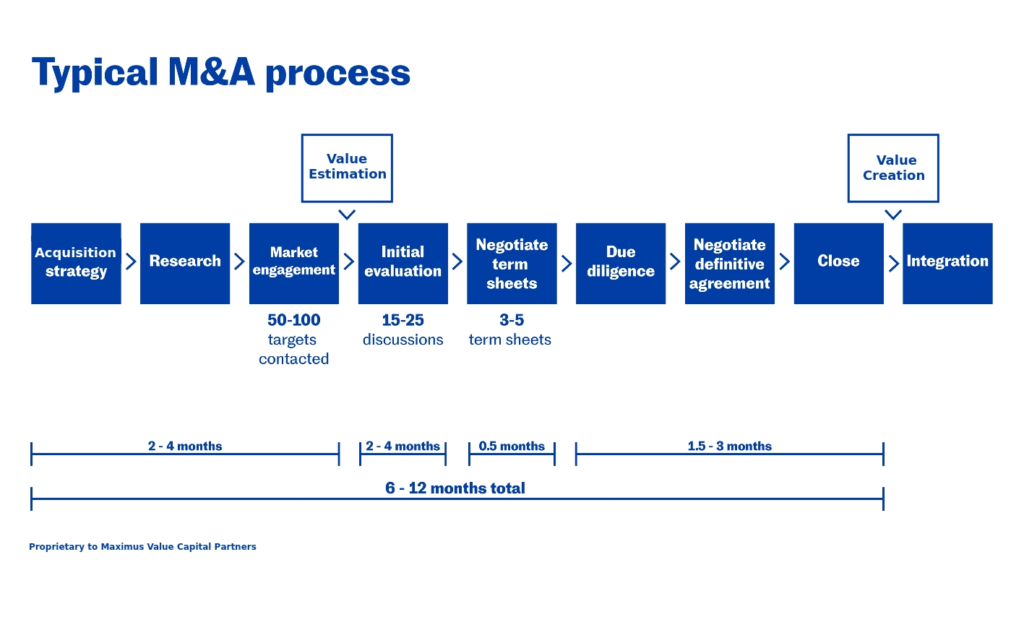

M&A Expertise

Improving EBITDA

SPAC Considerations

Quality Customer Services

Access to Top R&D

Transcending Technology Services

Securing and Licensing IP

High Yield Tax Free Bond Expertise

High Quality Lower Cost Offshore Support